When I've assessed financial models; sometimes, I've realized that Analysts tend to make mistakes because they treat bonds as stocks to simplify the computation of models widely known such as Value at Risk and Markowitz/Black Litterman.

Unlike stocks, bonds have a maturity, periodic coupon payments, interest rate risk and different default risk profile. As a result, the inputs parameters such as E(r) and V must be estimated differently. Correlations bring another problem to the analysis. Therefore, applying MV optimizations without taking into account those differences can lead to wrong results.

CHANDRASEKHAR's thesis (2009) address this topic, he analyzes the construction of bond fund portfolios or ETF as a simplified implementation of a portfolio optimization and mentions the use of term structure model based portfolio optimization as an alternative approach.

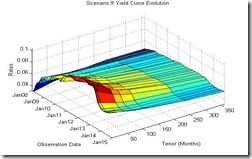

Caldeira, Moura y Santos (2014) implemented the MV approach to bond portfolio optimization based on dynamic factor models for the term structure of the interest rates proposed by Diebold and Li (2006). The factor model for the term structure allows to obtain the vector of expected yields and its covariance matrix then the bond return distribution is computed.