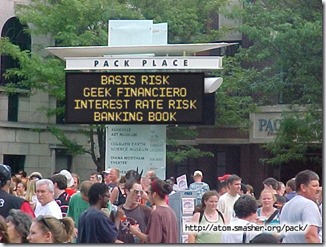

Basis risk is a type of interest rate risk. In the context of ALM, even when apparently the gap is zero in a bucket, there is still probably basis risk when the bank's assets and liabilities are priced on different indices.

For instance:

Assets priced on 6-Month Prime lending rate based loan funded by Liabilities 6-Month LIBOR based borrowing.

If the indices with the same repricing period do not move in the same way, there will be basis risk.

No hay comentarios:

Publicar un comentario